By Ed Travis

The 69th PGA Show was held last month in Orlando with most attendees voicing the opinion, “It’s great to be back.” They were referring to last year, when the show, due to the pandemic, was held virtually.

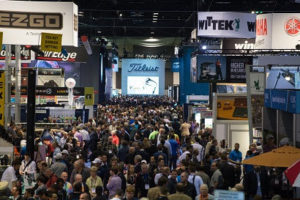

The PGA Merchandise Show is the primary annual gathering of the golf industry whose roots going back to 1954, when it was a small gathering, held in a Dunedin, Florida parking lot, with a few companies displaying their wares, from the trunk of their car. Since, it has grown dramatically becoming “The Major of the Golf Business.” Over 40,000 PGA Professionals, industry members and media attended the 2020 edition, that was held in the cavernous million square feet of the Orange County Convention Center, before COVID became an issue.

The Show serves several purposes for the PGA of America. Continuing education sessions are held for PGA members. Golf equipment companies, apparel, gear, as well as other golf service companies are on hand to gain exposure for their products to club professionals and retail buyers. Many apparel and service companies use the show to write orders for the coming season, as do smaller or boutique club makers, but the larger equipment companies do not since most of their clubs and balls are pre-ordered.

Major Networking

Another reason golf industry members continue to attend each year is the opportunity to meet-and-greet old friends, as well as, make new ones. It is a networking event like no other for those wishing to build relationships and assess the state of the industry.

The Covid crisis however changed the old ways of thinking and the method with which golf business is conducted.

The PGA projected the 2022 show would be somewhat smaller than the last one held onsite in 2020, but long-time show attendees were surprised by this year’s dramatic smaller size.

Comments about companies staying away due to the unknowns around the progress of the pandemic miss the point. These decisions are made often months in advance and generally are not subject to the latest headlines on the evening news about infection rates and other data. It is simply much less costly to keep the sales staff at home, not pay for expensive exhibitor space and still make sales virtually.

Surprising Numbers

Surprising Numbers

*Figures are not available at this writing, but a reasonable guesstimate is one-half the number of attendees—in the range of 20,000, but it was probably below 50%.

*The show’s website listed 578 exhibitors compared with roughly 1,000 in recent years. Plus, several exhibitors decided not to come at the last minute.

*Demo Day often has had 100 participating companies and this year a mere 40 were on hand.

*Normally 10,000-15,000 attend the Demo Day. This year that number was under 1,000.

*Of the 12 largest equipment companies only Bridgestone exhibited and two of the largest apparel companies, Nike and Adidas, chose not to have displays.

Last Gasp

The question then becomes, ‘Was this the last gasp of a dying event and have large trade shows lost their viability and relevance?’

We are not sure the small attendance of the 2022 PGA Show can be seen as an adequate predictor of future events, but changes are needed.

Long lines for daily attendees at the registration desk needs immediate consideration. Hundreds were stuck waiting in line to be processed for a badge. It was a frustrating situation for both those working the desk, as well as, those waiting to register.

The bigger question though for attendees and exhibitors is, How can the huge expense be justified?

The 36 Continuing Education Classes offered at the 2022 PGA Show are already being offered by the individual PGA Sections. Expanding the local and regional schedules can potentially remove a major reason for club professionals from the northern portions of the country to take a midwinter break in Orlando.

Return on Investment

Golf marketers especially the club and ball companies who in the past have occupied huge amounts of floorspace have reassessed their budgets and overall marketing strategies. With eleven of the largest manufacturers deciding not to spend millions of dollars for a booth, as well as, the cost for having their personnel spend a week at in Orlando, if we read the tea leaves correctly the show may not be providing an acceptable return on investment.

Large golf company executives have proudly supported the PGA of America and club Professionals by attending the show in the past, but today’s virtual selling drastically reduces cost for larger companies. The old saying “getting a bang for your buck” applies and though the PGA of America has indicated the no-shows will return in 2023, we are not certain this will be the case.

We may have just witnessed a colossal shift in sales marketing for large golf companies.

Networking thus becomes the major reason to attend. Most of those who did attend, me included, felt this year was a good, but not a great opportunity for substantive conversations.

Conclusion

The only conclusion, at this point, is the PGA Show is definitely in a transition phase. There will be a PGA Merchandise Show in 2023, bit it will be different. The number of exhibitors and industry members attending will probably not hit the pre-pandemic levels, but many if not most will be back.